Wealth Insights: Investment Strategies of the Rich and Famous Unveiled

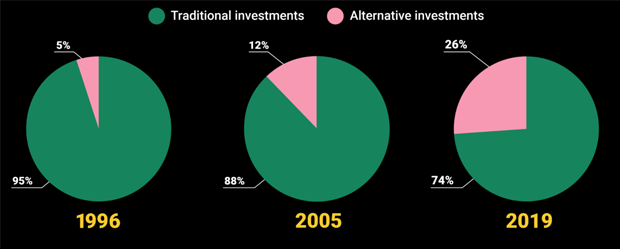

We previously made The Case for Alternative Investments and took a closer look at a few of these alts: Private Lending, Digital Assets, and Venture Capital. Today, we’re zooming in on the portfolio asset allocation of high-net-worth individuals.

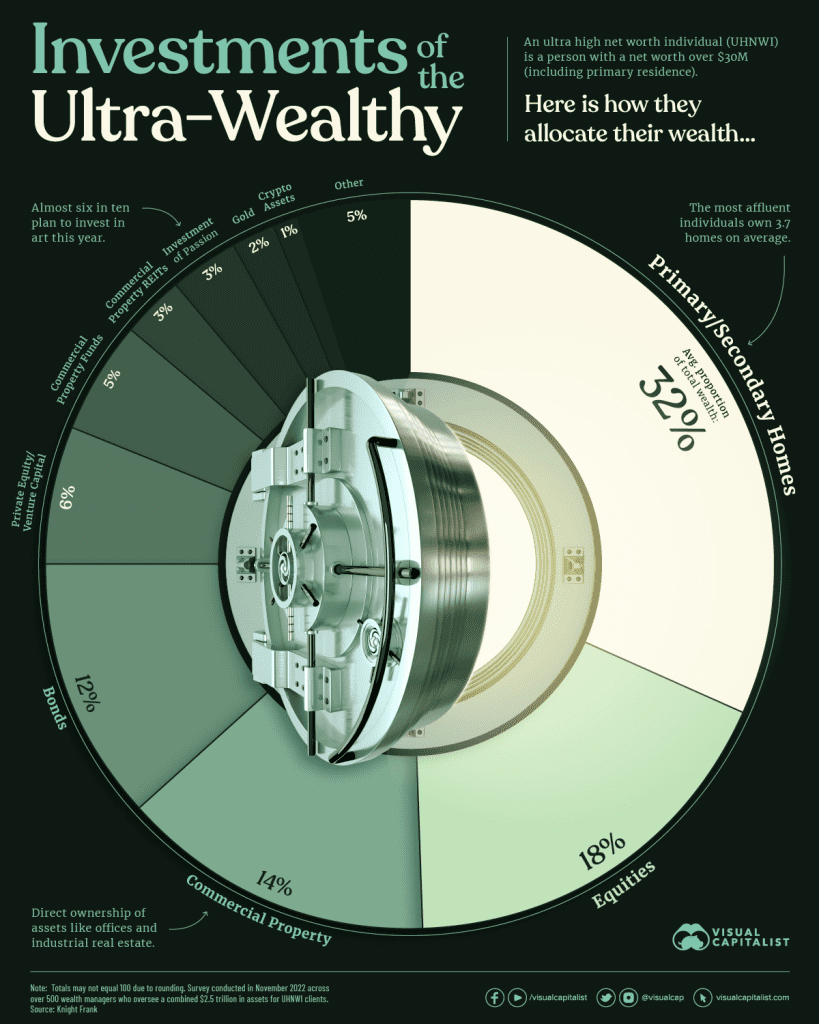

The world’s ultra-wealthy, with net worths exceeding $30 million, exhibit distinct investment patterns. Data from Knight Frank’s 2023 Wealth Report showcased the asset distribution of these individuals. Real estate (32%), equities (18%), and commercial property (14%) emerged as the top three allocations.

Luxury items, like art and wine, held a unique space in portfolios, reflecting both a penchant for opulence and a savvy investment eye. The expanding populace of the ultra-affluent, projected to rise by 29% in the next five years, heralds potential growth in luxury real estate and equity investments, aligning with their established investment tendencies.

The chart below from Visual Capitalist provides a summary of how the ultra-wealth allocate their investments.

High-net-worth individuals look beyond traditional public markets to diversify their portfolios. According to JP Morgan, private banking clients hold 15-30% of their portfolio in alternative investments. This is due to the increased return potential, enhanced diversification, and income generation that alternative investments can provide. There are a variety of asset classes available outside of traditional stock and bond portfolios waiting to be explored.