Venture Capital Essentials: Expert Strategies for Profitable Startup Investments

We previously made The Case for Alternative Investments and then took a closer look at Private Lending and Digital Assets. Today, we’re turning out attention to Venture Capital.

The allure of investing in startups often comes from the stories of early backers reaping substantial rewards. Peter Thiel and Facebook comes to mind. He bought 10.2% of Facebook for $500,000 in 2004 and Facebook (now known as Meta) is worth close to $800,000,000,000 today. That’s a lot of zeros.

For every home run like Facebook, there are countless failures. The venture capital terrain is laden with risks and requires a well-thought-out strategy. Instead of trying to pick individual startups, it is often wise to rely on the expertise of venture capitalists, and the diversification of their venture capital funds.

So what exactly is Venture Capital? Venture Capital (VC) represents a dynamic frontier for investors eyeing the startup ecosystem. It provides a structured and diversified pathway for funding and nurturing startups to success. Venture capitalists provide capital to startups in exchange for equity shares in the company. This form of financing helps startups grow when they are still too risky for standard capital markets or bank loans. Venture capitalists not only provide capital but also mentorship, strategic guidance, network access, and other resources.

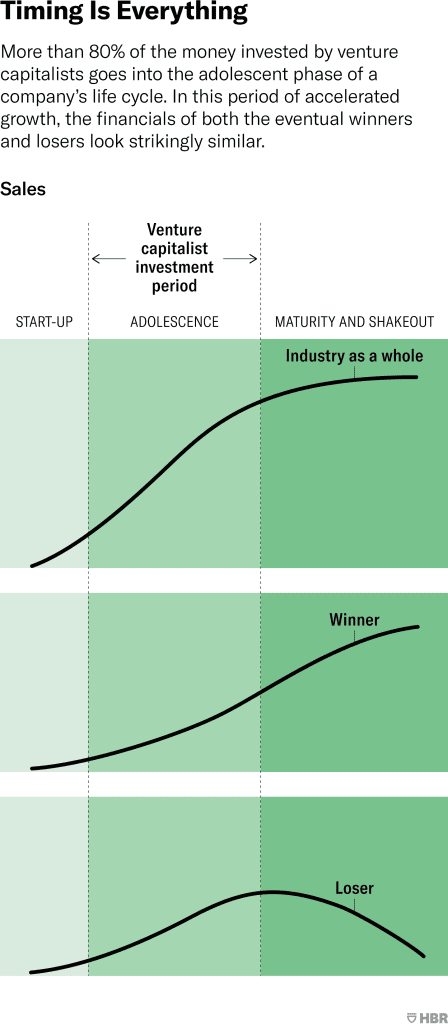

This chart from Harvard Business Review shows how similar “winners” and “losers” can look as they scale.

A good VC investment often entails:

1. Promising Market: A large, growing market with a clear demand for the startup’s product or service.

2. Strong Management Team: Experienced and capable founders and team members with a solid track record of success.

3. Unique Value Proposition: A distinctive product or service that solves a significant problem in the market.

4. Competitive Advantage: Barriers to entry that protect and insulate the startup from competition.

5. Scalable Business Model: A model that allows for growth with increasing returns to scale.

6. Exit Potential: Clear pathways for a profitable exit for investors through an acquisition or IPO.

7. Fit with VC’s Expertise: Alignment with the venture capitalist’s sector expertise and investment strategy.

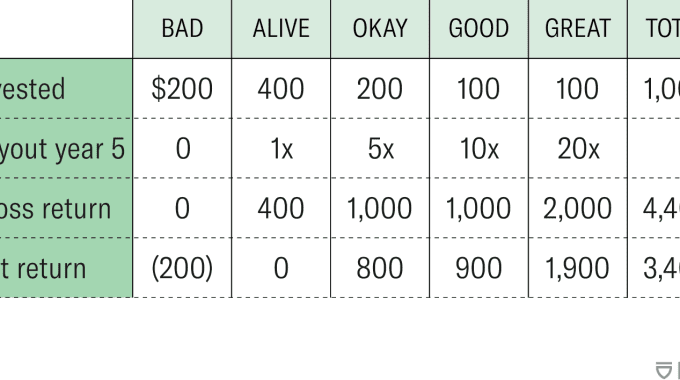

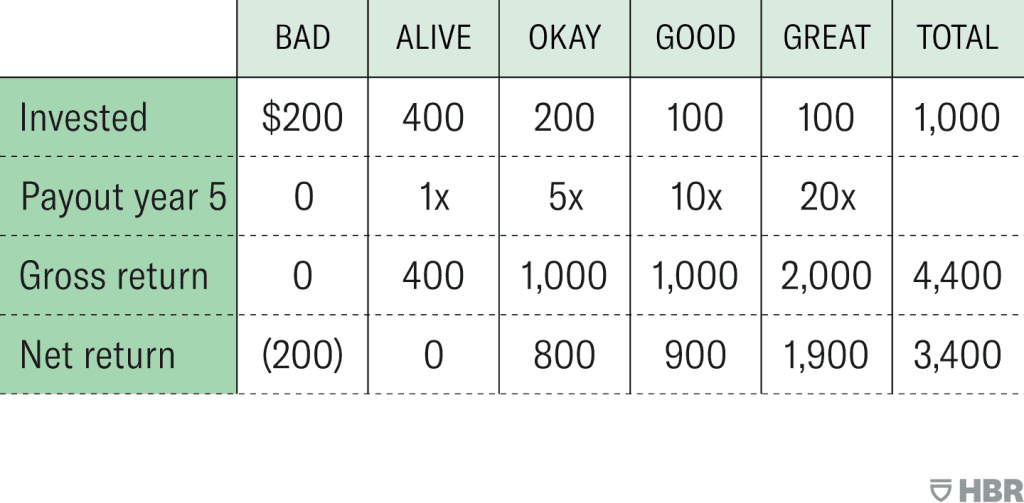

The chart below shows the typical breakout of portfolio performance per $1,000 invested in a VC fund. Some investments in a venture capital portfolio will go to 0. It takes several years before an investor knows how their venture portfolio performed.

Investing in startups is an adventurous endeavour, filled with potential pitfalls and windfalls. It’s not for everyone. Reach out to us to see if it might be a fit for you.