Navigating Interest Rate Cuts: Insights and Forecasts for 2024

As we delve into 2024, a crucial question looms over the global economy: when and by how much will the Federal Reserve cut interest rates? This decision is pivotal, especially in the aftermath of the rapid rate hikes throughout 2022. The 2024 Global Forecast Series provides a comprehensive visualization using data from the Federal Reserve, charting past interest rate cut cycles and collating forecasts from leading banks and institutions.

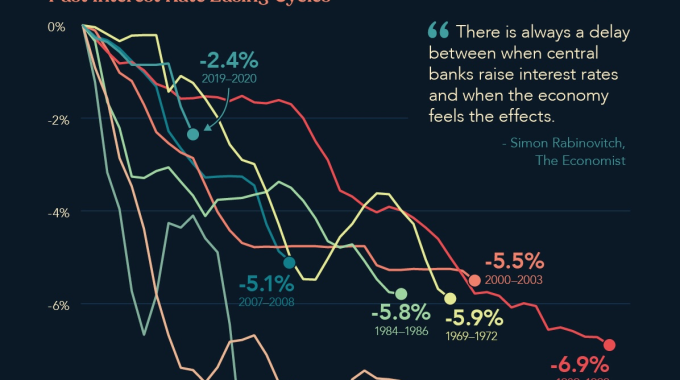

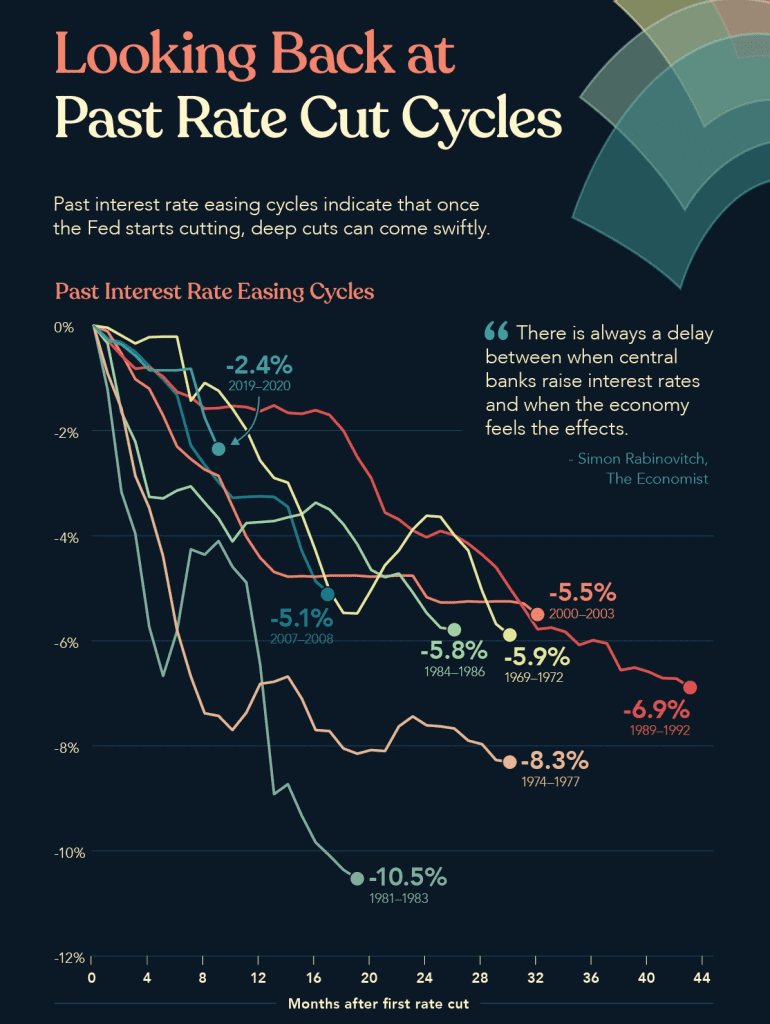

Looking Back at Past Interest Rate Cut Cycles

Historical patterns reveal that interest rate cycles are a delicate economic balancing act, often characterized by steep and swift rate hikes and cuts. Notable cycles include those from the 1970s and 1980s, showing the rapidity and magnitude of these adjustments. For instance, the 1981-1983 cycle saw a dramatic cut of -10.53% over 20 months. Such patterns indicate the Federal Reserve’s responsiveness to changing economic conditions, typically initiating cuts when the economy slows and inflationary pressures subside.

Institutional Forecasts for 2024

The latest cycle, triggered by significant rate hikes in 2022, has led to predictions of a similarly rapid series of rate cuts in 2024. Major institutions like J.P. Morgan, Deutsche Bank, and Morgan Stanley anticipate the first cut around mid-year, with outliers like UBS and Goldman Sachs expecting it as early as March. The consensus points towards a reduction of around 100 to 125 basis points, potentially bringing the Federal Funds Rate to approximately 4-4.25%.

Rate Cuts and the Prospect of Recession

Historically, rate cuts often coincide with recessions, either as a precursor or a delayed effect of tighter financial conditions from previous rate hikes. However, Federal Reserve Chair Jerome Powell expresses optimism, noting the potential for a more controlled economic cooldown, avoiding significant job losses typically associated with such cycles. With FOMC members projecting a more conservative year-end rate of 4.6%, the approach in 2024 may play a pivotal role in steering the economy away from a recession.

As we move through 2024, the eyes of investors and market analysts remain fixed on the Federal Reserve’s actions. Will the anticipated rate cuts follow the historical pattern, or will this cycle chart a different course? One thing is certain: understanding past trends and current forecasts is crucial for navigating these uncertain economic waters.