The Digital Asset Landscape: Unveiling New Horizons

Two weeks ago we made The Case for Alternative Investments before zooming in on Private Lending last week. This week, we’re taking a closer look at another alternative investment: digital assets.

The digital asset arena is a vast and dynamic field, offering a myriad of opportunities and risks for both seasoned and novice investors. Many of us are familiar with Bitcoin and Ethereum, but may be hesitant to include them, or any other digital asset, in our investment portfolios.

As we navigate through this digital evolution, let’s uncover the facets that are shaping the digital asset landscape and how they interlink with our alternative investment strategies.

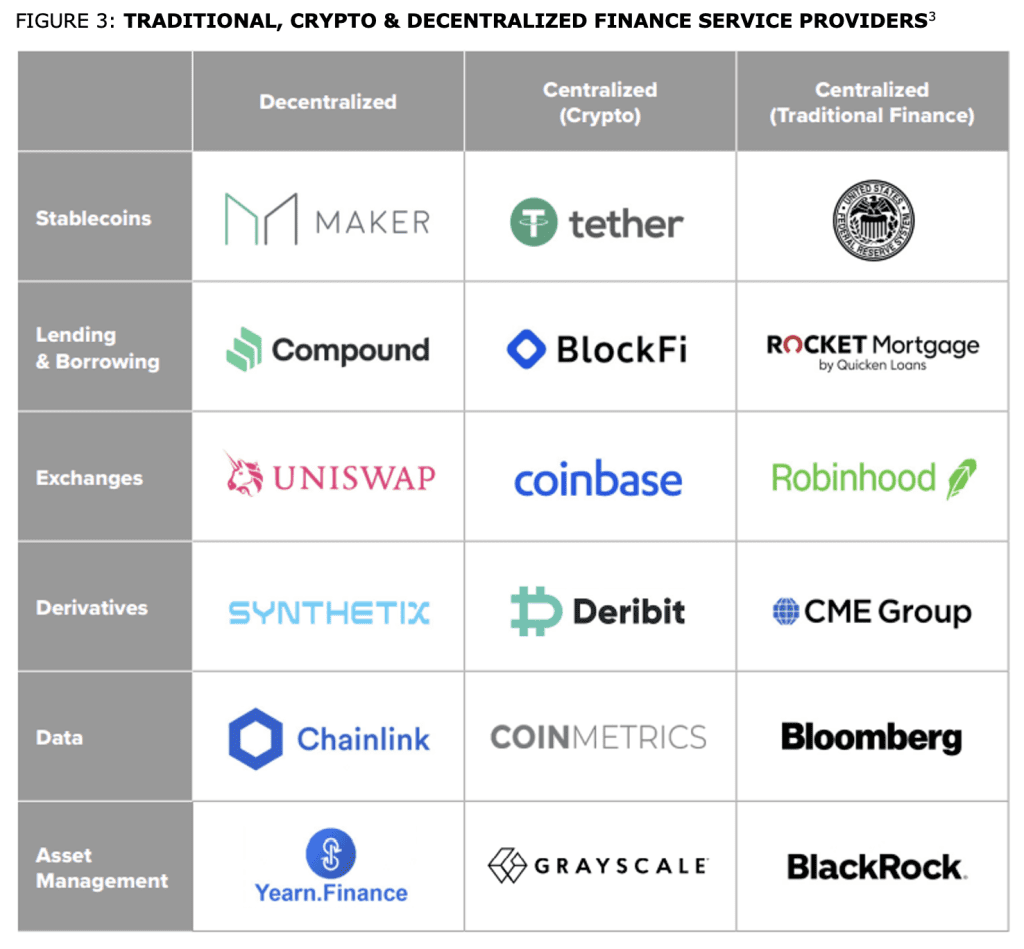

The chart below from Greyscale compares traditional, crypto, and decentralized financial service providers.

Why might investors consider digital assets in their investment portfolios?

1. Emerging Asset Classes

The digital asset ecosystem is burgeoning with a variety of asset classes including cryptocurrencies, stablecoins, Non-Fungible Tokens (NFTs), and Central Bank Digital Currencies (CBDCs). Each of these carries unique attributes and potential for wealth generation, expanding the traditional investment framework.

2. Inflation Hedge

Investors consider certain digital assets, namely Bitcoin, as a hedge against inflation, similar to gold. This is mainly due to the scarcity of Bitcoin. In a world where central banks are consistently printing money, it’s reassuring to know there is a hard cap of 21 million BTC.

3. Diversification

Digital assets like cryptocurrencies or tokenized securities often exhibit a low correlation with traditional asset classes like stocks and bonds. This characteristic can help in diversifying the risk within a portfolio.

4. Regulatory Clarity

As governmental bodies worldwide work towards formulating regulatory frameworks for digital assets, the clarity and legal structure will bolster investor confidence and foster a conducive environment for digital asset investments.

5. Global Market Access

Digital assets are accessible globally, providing investors with a broader market and potentially better opportunities for portfolio growth. Bitcoin is legal tender in a growing number of countries.

6. Technological Advancements

Continuous tech innovations are enhancing the security, usability, and overall experience of interacting with digital assets, thus drawing a broader investor base.

7. Environmental Sustainability

The shift towards eco-friendly blockchain networks and the emphasis on sustainable practices within the digital asset space align with the global sustainability goals, making digital assets a responsible choice for the modern investor.

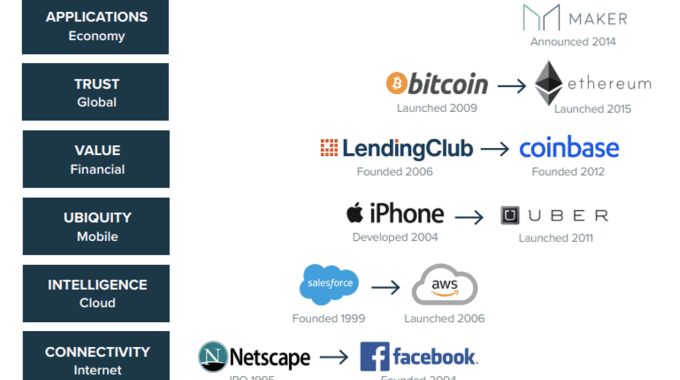

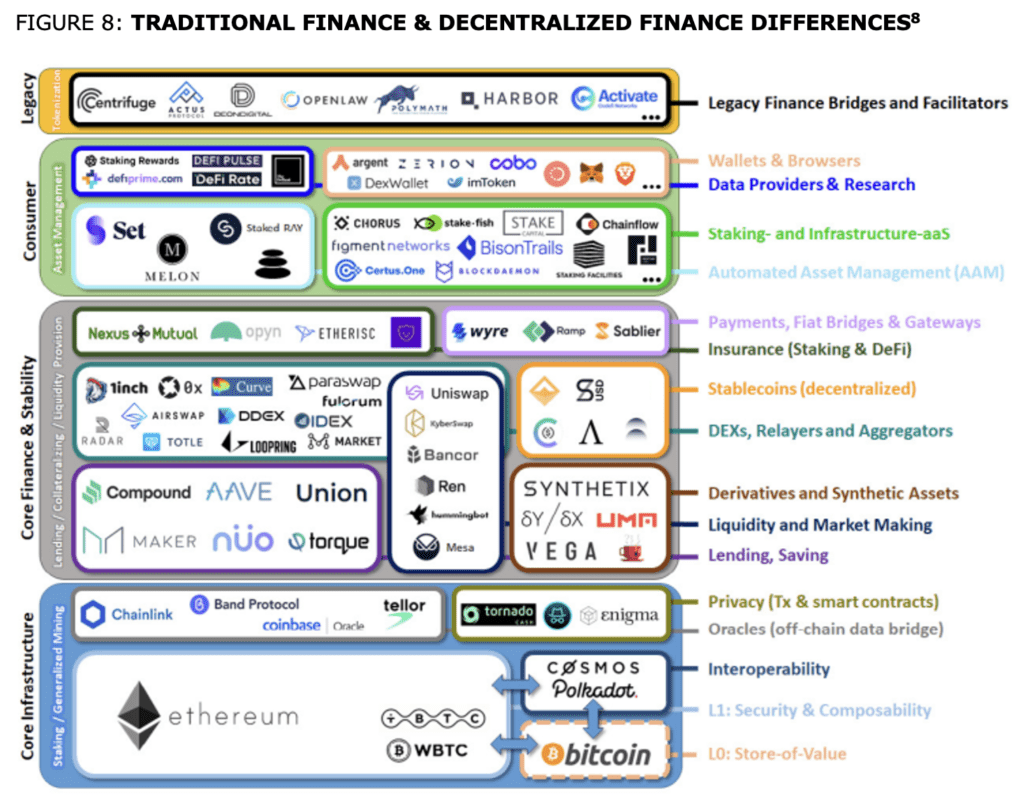

The digital asset space is busy, so it’s important to separate the signal from the noise. The chart below from Greyscale provides an outline of the industry.

As we steer through the exciting realm of digital assets, the horizon ahead is rich with potential and innovation. The fusion of digital and traditional assets presents a paradigm shift, opening doors to diversified investment strategies, enhanced liquidity, and a broader spectrum of wealth generation avenues.