Optimizing Wealth: Mastering the Risk/Return Tradeoff in Investment Strategies

Understanding the Tradeoff

The risk/return tradeoff implies that to achieve higher returns, an investor must accept a higher level of risk. By the same token, lower risk investments typically yield lower returns. This concept is crucial in developing an investment portfolio that reflects an investor’s financial objectives and risk appetite.

Assessing Risk Tolerance

Risk tolerance varies significantly among investors. Some may be comfortable with high volatility while others prefer steady, safer returns. Understanding your risk tolerance is the first step in crafting an investment strategy that suits you.

Diversification: The Key to Balance

One effective strategy to manage the risk/return tradeoff is diversification. By spreading investments across various asset classes, geographical regions, and industries, investors can mitigate risk without necessarily compromising on potential returns. Diversification is particularly relevant in the context of alternative investment management, where unique opportunities can balance traditional assets.

The Role of Time Horizon

Investment time horizon is also a crucial factor. Long-term investors may find that they can afford to take on more risk, as they have more time to recover from market downturns. Short-term investors, on the other hand, need to be more conservative.

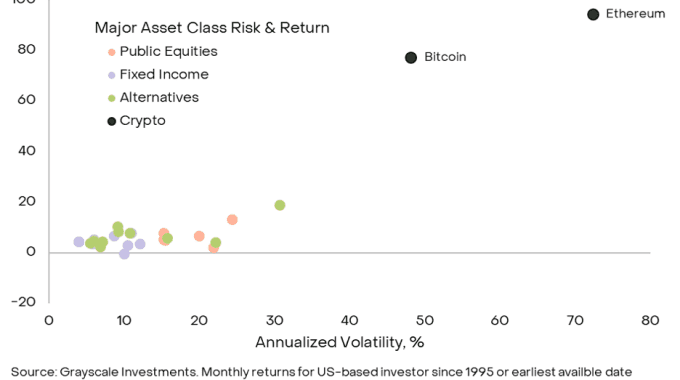

The chart below from Grayscale shows the risk (volatility) and return of various asset classes:

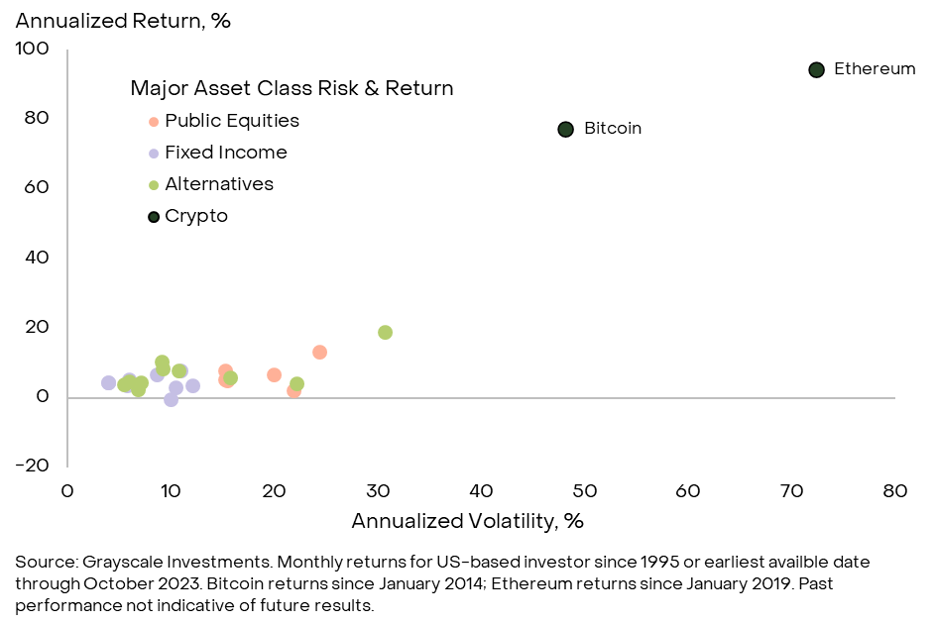

Zooming out show the heightened volatility and return potential of digital assets, as shown below:

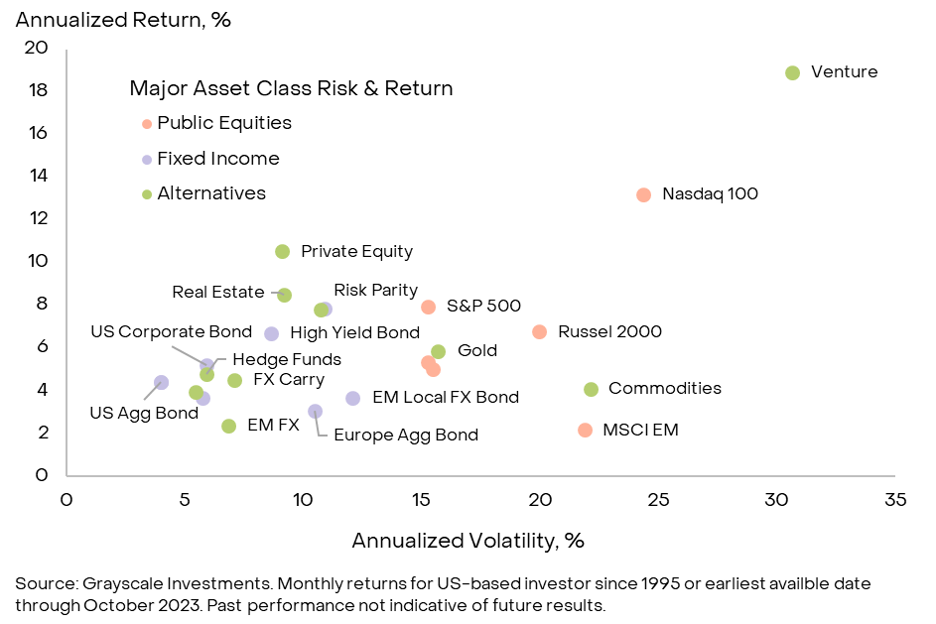

Crafting a diverse portfolio that yields robust returns is becoming increasingly challenging. The traditional mix of 60% stocks and 40% bonds is less likely to replicate the impressive returns seen over the past four decades. Moreover, the correlation between stocks and bonds has heightened, diminishing the diversification benefits once gained from combining them.

To enhance the balance between risk and reward in their portfolios, investors can shift towards asset classes that offer either improved risk-adjusted returns, lower correlations, or a combination of both. Investors may be able to optimize their portfolio by investing in alternatives.