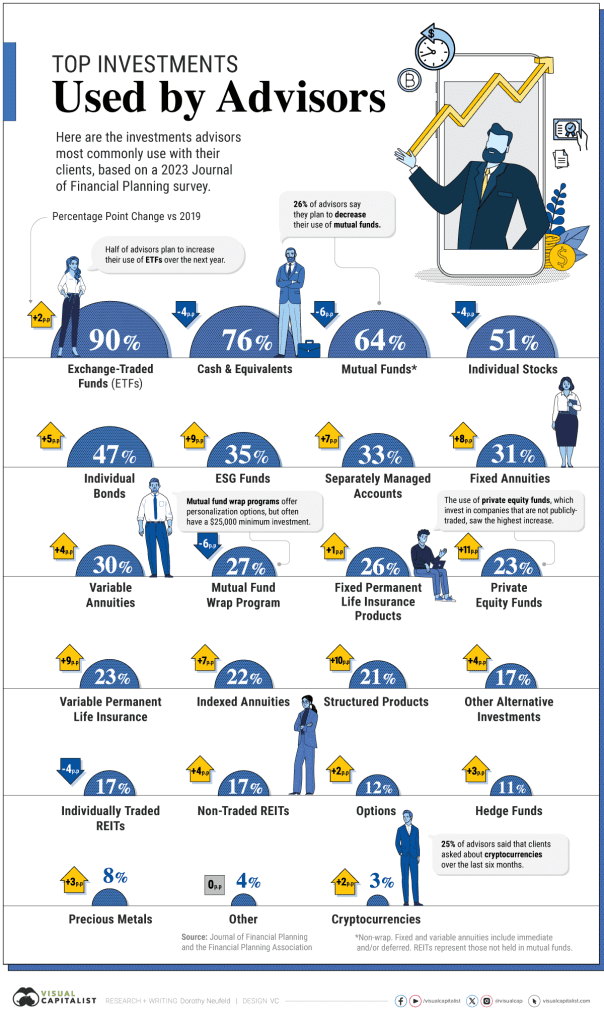

The Top Investments Used by Financial Advisors in 2023

As the financial landscape continues to evolve, financial advisors are adapting their strategies to meet the changing economic environment. In recent years, there’s been a significant shift in how client portfolios are built, influenced heavily by the economic climate of high interest rates and inflationary pressures.

Top Investments in 2023

- Exchange-Traded Funds (ETFs): Dominating the investment space, ETFs were used by 90% of advisors in 2023, with many planning to increase their usage. Their popularity is driven by their versatility and efficiency in tracking various market indices, as well as their low fees.

- Cash and Equivalents: Despite a slight decline since 2019, cash and equivalents, including money market funds, remain a staple in portfolios. They offer stability and liquidity, important in uncertain markets.

- Private Equity Funds: These funds, investing in privately-held companies, have seen the most significant growth among investment types, indicating a trend towards alternative investments.

- Mutual Funds: There’s been a noticeable decline in the use of mutual funds among advisors, possibly due to the increased preference for ETFs with lower fees and other investment vehicles.

- Cryptocurrencies: While only a small percentage of advisors use cryptocurrencies, the high returns reported for assets like Bitcoin highlight their potential as a high-reward, albeit high-risk, investment option.

Revisiting the 60/40 Portfolio

The traditional 60% stock and 40% bond portfolio remains relevant. In 2023, it showed a promising return of 13%, and many advisors remain confident in its ability to yield similar returns historically.

See the chart below from Visual Capitalist:

Future Outlook

Investment choices have expanded dramatically, with managed investment products increasing exponentially over the years. This variety offers both opportunity and the challenge of decision paralysis for investors.

2023 has been a transformative year for investments. Financial advisors have adapted by diversifying portfolios and increasingly turning to alternative investments like private equity funds and ETFs. The traditional 60/40 portfolio continues to hold its ground, suggesting that some classic strategies still maintain their relevance in modern portfolio management.