Navigating the Waves of the Market: Understanding Stock Market Cycles

In the ever-evolving world of finance, the stock market presents a landscape marked by cycles of growth and decline. Today’s market, exemplified by the S&P 500’s significant climb amidst strong economic growth and fluctuating interest rates, stands as a testament to these complex cycles. With an unemployment rate holding steady at 3.7% as of November and moderated inflation, the current market offers a unique case study in understanding these patterns.

The Rhythm of Bulls and Bears

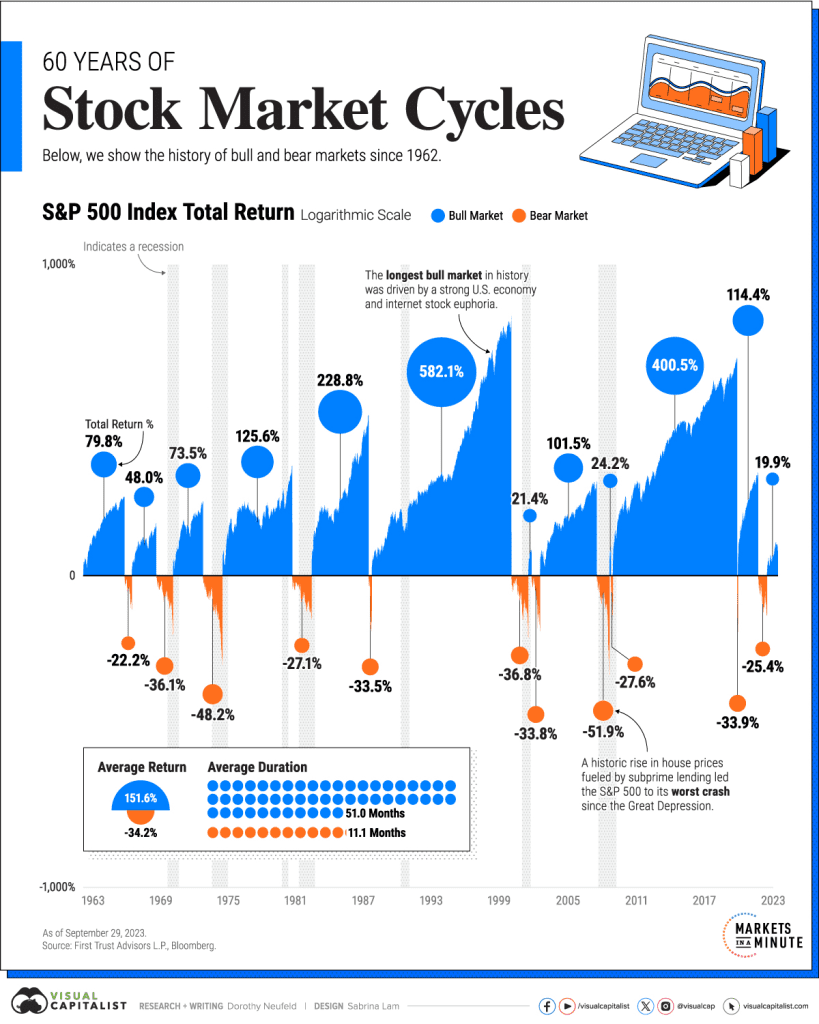

Historically, stock market cycles have been categorized into two main phases: bull markets, signifying growth, and bear markets, indicating decline. A bear market is declared when a stock market index falls 20% from its peak. Conversely, a bull market commences when the market not only recovers from these losses but also surpasses the previous high. This pattern can span months or even years.

- Bull Market: Average Return of +151.6%, lasting 51.0 months.

- Bear Market: Average Return of -34.2%, lasting 11.1 months.

Since 1962, bear markets have generally been shorter in duration compared to their bull counterparts. Notably, the bear markets in the early 1970s and 1980s, triggered by high inflation and stringent monetary policies, each lasted approximately 20 months. The bull market of the 1990s, fueled by a robust U.S. economy and the Dotcom boom, stretched over 12 years, showcasing a staggering 582.1% advance in the S&P 500.

A chart from Visual Capitalist to visualize market cycles:

Stock Market Peaks and Economic Indicators

A noteworthy aspect of stock market cycles is their predictive nature regarding economic downturns. For instance, the S&P 500 peaked in October 2007, preceding the official start of the recession in December. Similarly, the peak in September 2000 came six months before the 2001 recession began. These patterns underscore the importance of vigilance in monitoring market trends.

Strategies for Weathering Bear Markets

While predicting the onset of a bear market is challenging, investors can adopt strategies to fortify their portfolios. Diversification across various sectors and asset classes stands out as a key approach. For instance, while cyclical sectors like technology and real estate thrive in bull markets, defensive sectors such as consumer staples often outperform during downturns. Incorporating bonds and international stocks into a portfolio can further mitigate risk, thanks to their lower correlation with U.S. equities.

The S&P 500’s historical average return of +11.5% since 1928 highlights that, despite the inevitable fluctuations, the majority of stock market cycles tend to favour bull markets. Understanding these cycles is crucial for investors aiming to navigate the market effectively. By staying informed and diversifying their investment approach, they can not only weather the storms but also capitalize on the opportunities presented by these ever-changing cycles.