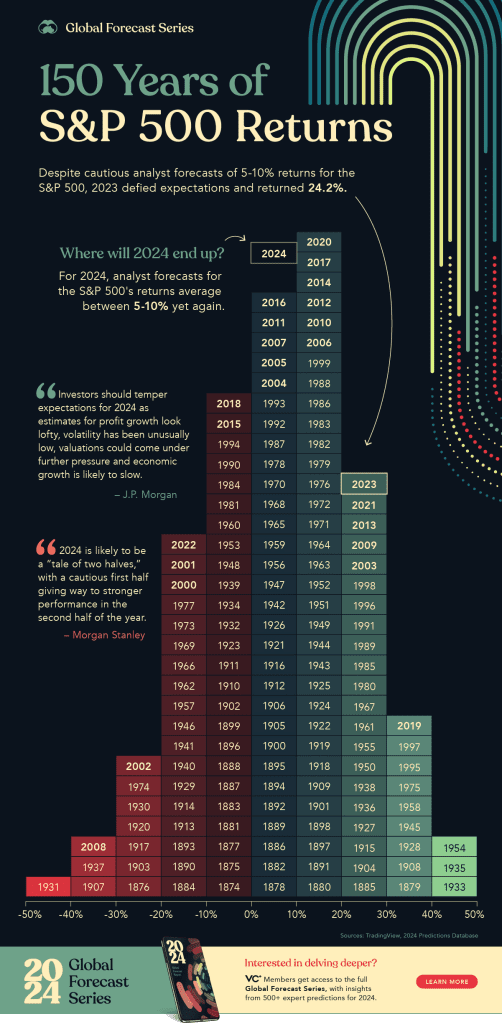

Visualizing 150 Years of S&P 500 Returns: A Remarkable Rally in 2023

The Unexpected Surge of the S&P 500 in 2023

2023 was anticipated to be a challenging year for the stock market. However, defying expectations, consumers adjusted to higher interest rates, and investors demonstrated optimism, significantly influenced by the excitement surrounding advancements in AI. This enthusiasm translated into a substantial 24% rally in the S&P 500.

Historical Context: S&P 500 Returns Since 1874

To appreciate the significance of these gains, it’s essential to view them against the backdrop of the S&P 500’s performance over the last 150 years. Data from TradingView reveals a fascinating story of the index’s yearly returns since 1874, offering a comprehensive view of its historical trajectory.

2023: The Year of the “Magnificent Seven”

A crucial factor in driving the S&P 500’s impressive returns in 2023 was the formidable performance of seven mega-cap companies, nicknamed the “Magnificent Seven”. This group, comprising Amazon, Apple, Nvidia, Tesla, Microsoft, Meta, and Alphabet, played a pivotal role in bolstering the index. Remarkably, 72% of stocks underperformed against the S&P 500, making 2023’s market returns not just rare, but also exceptionally strong.

Analyzing the Frequency of S&P 500 Returns

The distribution of annual returns of the S&P 500 presents an intriguing pattern, akin to a bell curve. Most returns cluster near the middle, with the highest frequency in the 10% to 20% range. Here’s a breakdown of the S&P 500’s annual returns and their occurrence over the years:

- +40 to +50% or more: 2.0% of years

- +30 to +40%: 5.4% of years

- +20 to +30%: 14.1% of years

- +10 to +20%: 22.1% of years

- 0 to +10%: 20.1% of years

- 0 to -10%: 16.8% of years

- -10 to -20%: 12.1% of years

- -20 to -30%: 4.7% of years

- -30 to -40%: 2.0% of years

- -40 to -50% or more: 0.7% of years

The Best and Worst Years of the S&P 500

The most remarkable year in S&P 500 history was 1933, with a nearly 54% surge during the Great Depression. This was largely influenced by the establishment of the Federal Deposit Insurance Corporation (FDIC), which restored banking confidence. In stark contrast, the worst year was 1931, witnessing a 43% plummet amid the U.S. banking system collapse. A similar downturn occurred in 2008.

Anticipating the S&P 500’s Performance in 2024

Reflecting on the unpredicted surge in 2023, Andrew Pease, Chief Investment Strategist at Russell Investments, noted the inaccuracy of that year’s consensus. Goldman Sachs, however, correctly foresaw the economy’s resilience. For 2024, Goldman Sachs predicts more modest growth for the S&P 500, estimating a 7% increase. Analysts collectively project a 5-10% return, indicating a cautiously optimistic stance.