Index Investing Explained: Building Wealth With Proven Investment Strategies

Index investing is a passive investment strategy that seeks to replicate the market instead of trying to pick individual winners. Indexing offers greater diversification and lower fees than it’s counterpart, active investing. History shows that index investing often outperforms active investing as an investment strategy.

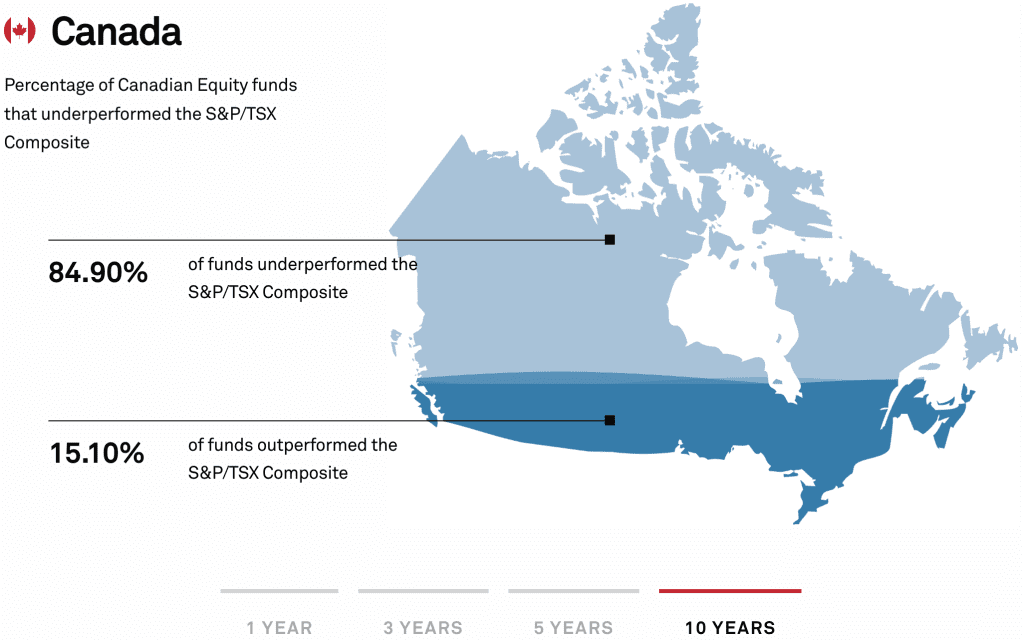

The graphic below is from S&P Dow Jones Indices and measures actively managed funds against their index benchmarks. Over the last 10 years, almost 85% of Canadian actively managed funds have underperformed their index.

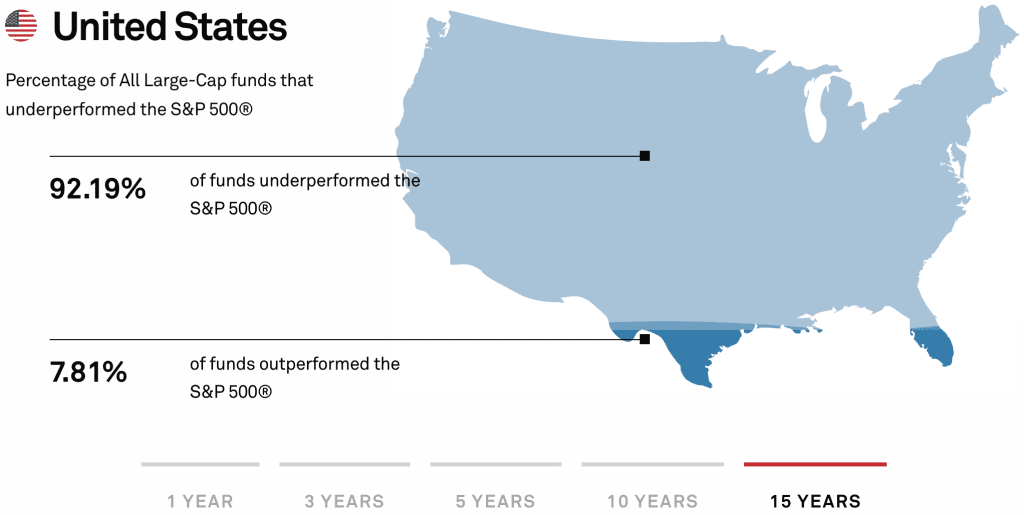

US data goes back further and the results are even worse. Less than 8% of American actively managed funds outperformed their index over the last 15 years.

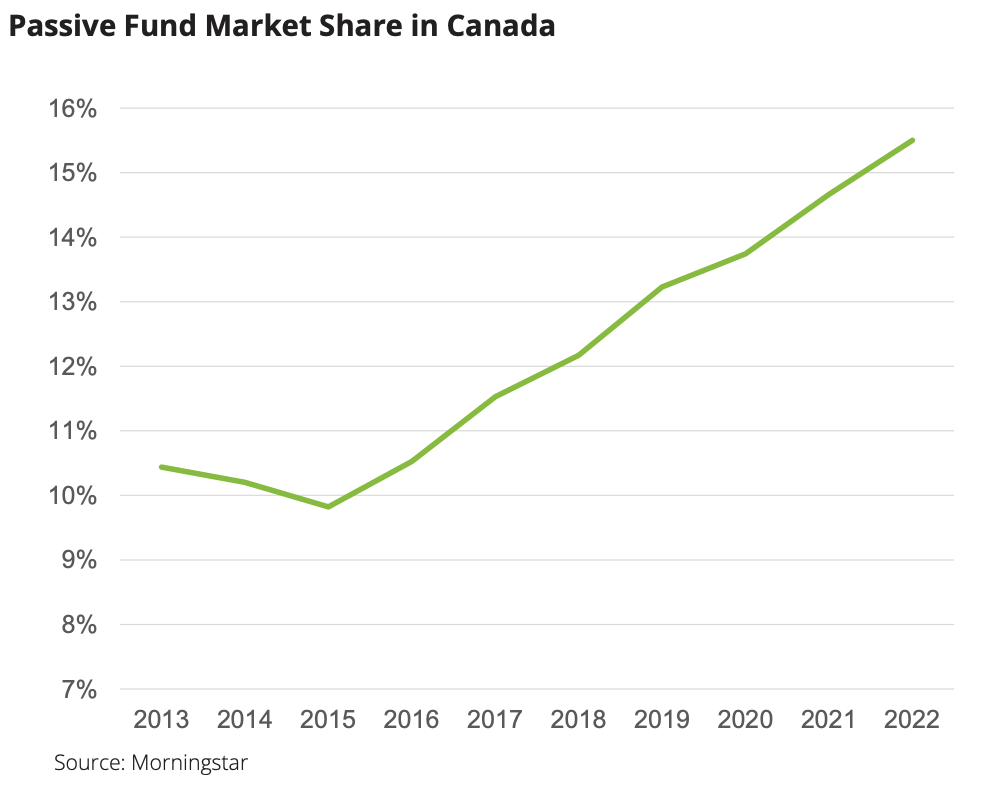

What makes the data so surprising is that a whopping 84.5% of Canadian assets under management are actively managed. That is despite the vast majority of actively managed funds underperforming index funds over 10+ years.

The chart below shows this trend changing. Canadians are becoming more comfortable with passive index investing.

In the face of all this data, index investing can make sense for many investors. Unless you are able to find an active manager with a track record of outperforming the index, it likely makes sense to simply replicate the market with an index fund.