Navigating Interest Rate Fluctuations: A Canadian Perspective

In the evolving finance landscape, interest rates are a critical factor shaping investment strategies and decisions. Investors should understand how these rates are set and their consequential impact on mortgages and investment portfolios. This guide aims to demystify interest rates, offering insights to optimize financial outcomes.

Decoding Interest Rate Determination

- Central Bank Strategies: The Bank of Canada’s monetary policy is a primary driver of interest rate trends. Adjustments to the policy rate are made to manage inflation and economic stability. Insight into central bank strategies offers investors a predictive edge in anticipating market shifts.

- Market Dynamics: The interplay of supply and demand for money in the market, influenced by economic growth, inflation expectations, and global financial events, plays a crucial role. Understanding these dynamics allows investors to better predict interest rate movements.

- Government Fiscal Policies: Government spending and taxation decisions indirectly sway interest rates. A nuanced understanding of fiscal policies can give investors a comprehensive perspective on future interest rate trends.

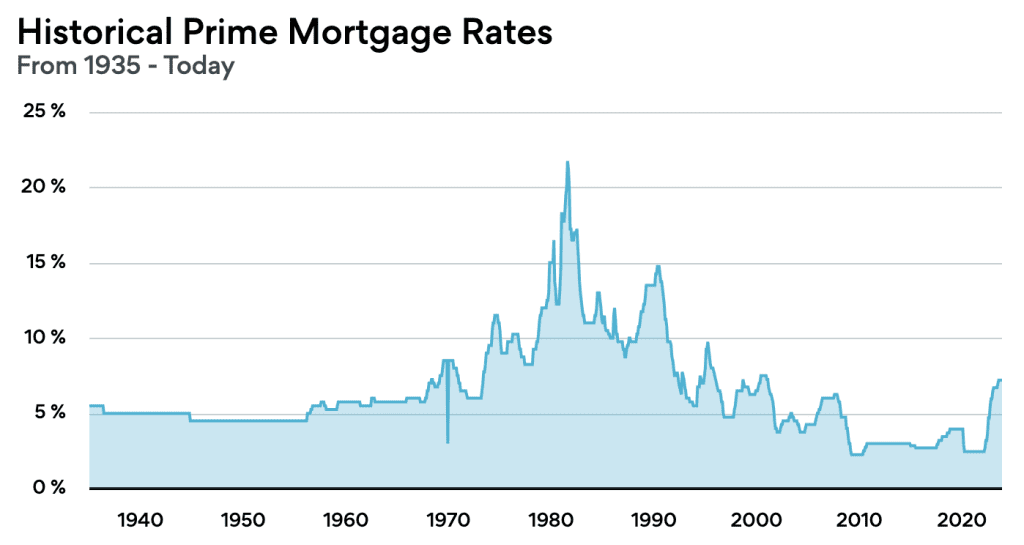

The chart below shows the Prime Rate in Canada, which currently sits at 7.2%.

Impact on Mortgages for Investment Properties

- Choosing Mortgage Types: Understanding the difference between variable and fixed-rate mortgages is crucial. While variable rates offer potential short-term savings, fixed rates provide long-term stability – a key consideration for property investors.

- Market Timing: The interest rate environment significantly impacts property affordability and market demand. Strategic investors can leverage this knowledge to time their real estate investments effectively.

- Refinancing Strategies: In a fluctuating rate environment, refinancing can unlock significant value. Savvy investors actively monitor rate trends to capitalize on refinancing opportunities.

Interest Rates and Investment Portfolio Management

- Bond Market Sensitivity: The inverse relationship between interest rates and bond prices is a fundamental concept. Astute investors use this knowledge to adjust their bond portfolio strategies in response to rate changes.

- Stock Market Responses: Understanding sector-specific reactions to interest rate changes can lead to informed stock investment decisions. While higher rates may strain some sectors, they can benefit others, like financial services.

- Diversifying with Alternative Investments: Alternatives can diversify a portfolio’s response to interest rate changes. Savvy investors balance their portfolios across different asset classes to mitigate risks associated with rate fluctuations.

For the shrewd investor, a deep understanding of interest rates is not just beneficial – it’s essential. It enables informed decision-making in mortgage management and investment portfolio diversification. Keeping abreast of rate trends and economic indicators empowers investors to make strategic choices that align with their financial goals.