Diversifying Wealth: The Case for Alternative Investments

Last week I made the case for why index investing is a good strategy. With the value of global equity markets estimated at $124 trillion versus just $10 trillion for private markets (per McKinsey and SIFMA), it makes sense for index investments to makeup the majority of one’s portfolio. In the modern financial landscape, traditional assets like stocks and bonds are the staples of many investment portfolios. However, the savvy investor often looks beyond the conventional to alternative assets.

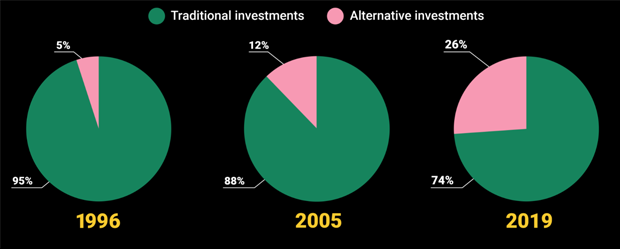

Alternative investments allow for access to broader opportunity sets, enhanced diversification, and premium income generation potential. So what are they anyway? Alternative investments include real estate, digital assets, commodities, private debt, collectibles, private equity, and hedge funds. Investors are becoming increasingly comfortable with alternative investments, as shown below (per Bloomberg).

Benefits of Alternative Investments:

1. Diversification

Alternative assets provide a cushion against the volatility inherent in traditional markets. Their performance tends to be less correlated with that of mainstream assets, which can be particularly beneficial during economic downturns.

2. Potential Higher Returns

The allure of higher returns is often a driving force behind the exploration of alternative assets. Investments like private equity and venture capital have the potential to yield significant returns, although they do come with higher risk.

3. Inflation Hedging

Assets like real estate and commodities often act as effective hedges against inflation, preserving purchasing power in times of rising prices.

4. Income Generation

Certain alternative assets can provide a steady income stream. For instance, real estate can provide rental income, and private lending can generate interest income.

5. Tangible Value

Unlike stocks and bonds, some alternative assets have intrinsic, tangible value. Real estate, art, and commodities like gold have inherent value which can be reassuring to investors.

6. Innovation and Growth

Alternative assets like venture capital and digital assets provide an opportunity to invest in innovation and growth sectors, potentially driving substantial long-term gains.

7. Portfolio Longevity

Through diversification and potentially higher returns, alternative assets can contribute to the longevity of an investment portfolio, which is essential for long-term financial planning.

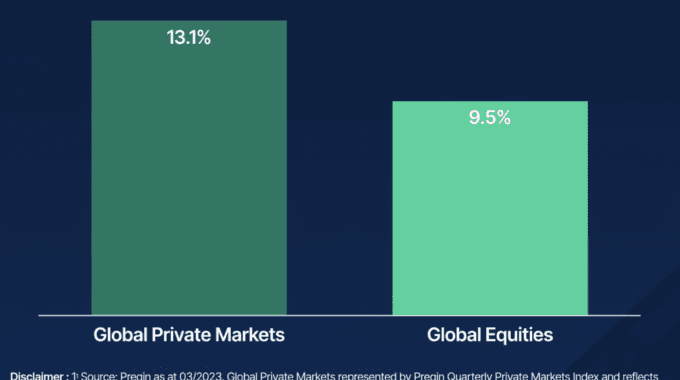

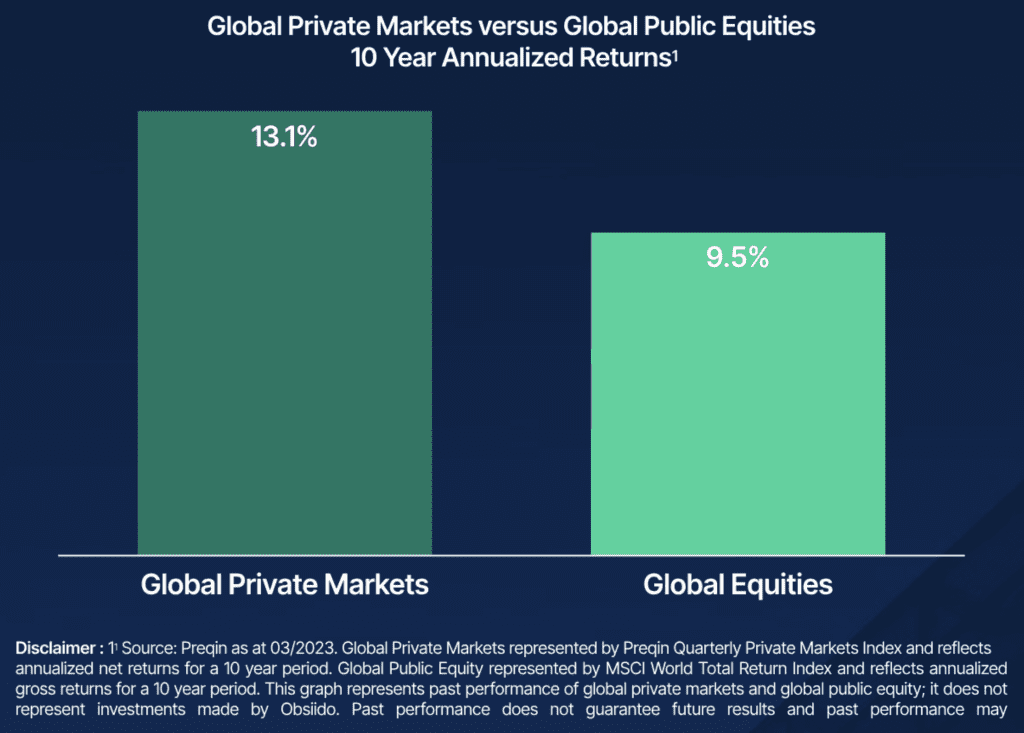

Here’s a performance chart from Obsiido:

Investing in alternative assets requires a well-thought-out strategy and a clear understanding of the associated risks. It’s an avenue worth exploring for those looking to broaden their investment horizon and work towards achieving robust financial security.