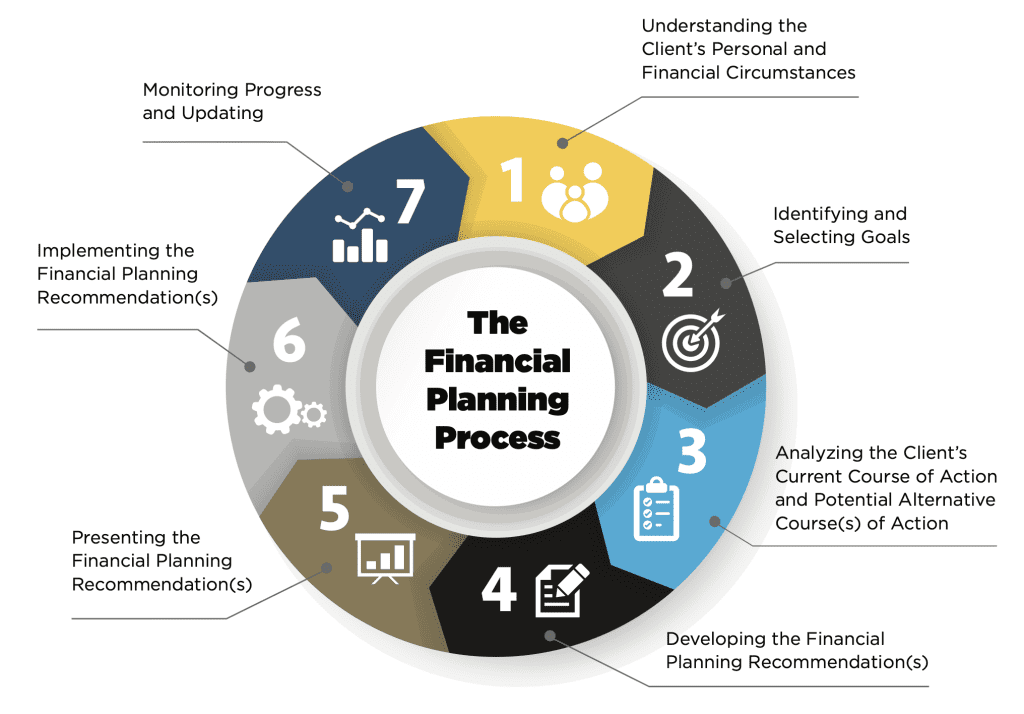

Defining Your Goals and the Financial Planning Process

Financial success doesn’t happen by chance; it is often the result of a deliberate and structured financial planning process. At the heart of this process is the clear definition of financial goals. Whether you are an entrepreneur, a seasoned investor, or just starting out, understanding the importance of setting goals and following a strategic financial planning process is crucial.

The Importance of Defining Financial Goals

Defining your financial goals is perhaps most critical step in the financial planning process. These goals serve as a roadmap, guiding your investment decisions and strategies. They can range from short-term objectives like saving for a vacation, to long-term aspirations like retirement planning or buying a cottage. Goals give purpose to your financial decisions and help you stay focused and motivated.

Types of Financial Goals

- Short-term Goals: These are objectives you wish to achieve within a few years, such as saving for a down payment on a house or funding an entrepreneurial venture.

- Medium-term Goals: These are typically set for a timeframe of five to ten years and might include saving for your children’s education or expanding your business.

- Long-term Goals: These are for the distant future, often revolving around retirement planning, estate planning, or reaching a significant net worth milestone.

Key Considerations in Financial Planning

- Risk Tolerance and Investment Horizon: Understanding your risk tolerance and investment horizon is crucial in aligning your financial plan with your comfort level and time frame.

- Diversification: As highlighted in previous discussions, diversification across asset classes can help manage risk and enhance returns.

- Tax Planning: Efficient tax planning strategies are integral to maximizing your earnings and savings.

- Estate Planning: Ensuring that your wealth is managed and distributed according to your wishes is a key aspect of long-term financial planning.

- Professional Guidance: Consulting with financial experts like Certified Financial Planners or Chartered Investment Managers can provide valuable insights and guidance.

The journey to financial success begins with clear goals and is navigated through a well-thought-out financial planning process. By defining your goals and adhering to a structured approach, you can make informed decisions, mitigate risks, and systematically move towards achieving your financial aspirations. Remember, the most successful financial plans are those that are regularly reviewed and adapted to changing circumstances and goals.