Understanding Canadian Housing Affordability: Challenges and Opportunities for Homebuyers

Did you know the average home in Canada costs $754,000 (per Gurgavin Capital)? That’s up from $454,776 in January of 2019 (per Canadian Real Estate Association). Canadian home prices increased by 65.8% in less than 4 years. That’s great for homeowners, but not so great for homebuyers.

The issue here is that Canadian incomes did not increase at the same rate. With interest rates where they are, the minimum income required to purchase the average Canadian home is $180,075. Even someone in the top 10% of earners In Canada, with an average income of $175,000, would not qualify for a mortgage to purchase the average Canadian home. However, it hasn’t always been this way.

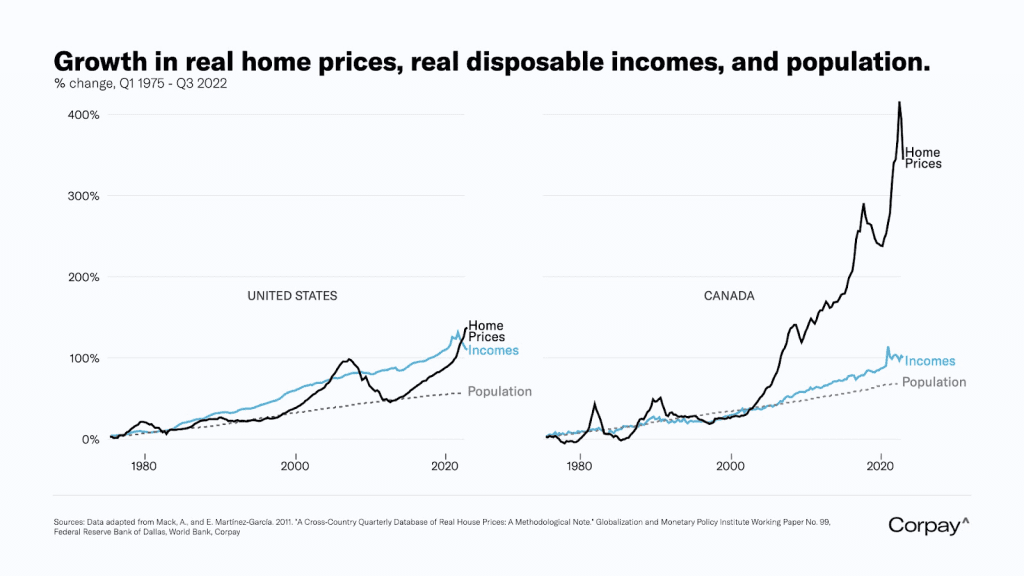

The chart below compares the growth in home prices, disposable income, and population between Canada and our neighbours to the South.

As you can see, home prices and incomes have followed a similar trajectory in the US, but that has not been the case in Canada.

Did you know? Most American mortgages have a 30 year team with no mortgage renewal necessary. Canadian mortgages generally come in terms of 5 years or less.

What are some factors affecting the price of housing? Let’s take a look:

ECONOMIC FACTORS

- Interest Rates: Higher interest rates usually lead to lower home prices because the cost of borrowing increases.

- Employment and Wages: A robust job market and higher income can lead to increased demand for housing.

- Economic Indicators: GDP, inflation, and other economic indicators can influence buyer and seller confidence.

LOCATION

- Neighborhood: School quality, crime rates, and amenities can influence home prices.

- Proximity to Major Cities: Being near a city usually means higher home prices.

- Geographical Limitations: Natural boundaries like oceans and mountains can limit supply, thereby increasing price.

SUPPLY AND DEMAND

- Housing Supply: More supply generally means lower prices.

- Population Growth: Increased population can lead to higher demand, raising home prices.

PROPERTY CHARACTERISTICS

- Size and Layout: Larger homes usually cost more.

- Age and Condition: Newer and well-maintained homes are generally more expensive.

- Upgrades and Features: Amenities like a swimming pool, modern appliances, and energy-efficient features can increase value.

MARKET SENTIMENT

- Investor Activity: High investor demand can drive up prices.

- Consumer Confidence: If people believe their income will increase in the future, they’re more likely to buy homes, pushing up prices.

Because the price of housing is affected by a variety of factors outside an individual’s control, it’s important to focus on what can be controlled: yourself.