Navigating the Investment Maze: Avoiding Common Mistakes

Investing can sometimes feel like navigating a maze, where a wrong turn can set you back financially and lead you into a dead end. Seasoned navigators and newcomers alike can fall prey to investing missteps. The art of investing isn’t just about making decisions—it’s about making informed ones. The terrain is riddled with potential pitfalls so let’s shine a light on some of the most common blunders to help you steer clear of them.

Expectations vs. Reality: The Balancing Act

The journey starts with setting realistic expectations. Anticipating astronomical returns can distort your investment compass, leading to rash decisions. A pragmatic outlook anchors your strategy, allowing you to weather market storms without losing direction.

The Blueprint: Defining Your Investment Goals

Without a destination, any path will do. The same goes for investing—without clear, long-term goals, you’re wandering aimlessly. Whether you’re saving for retirement or building a college fund, your goals are the blueprint that guide your investment decisions.

The Diversification Dilemma: Not Putting All Eggs in One Basket

Diversification isn’t just investment jargon; it’s a lifeline. It’s the difference between a single stock torpedoing your portfolio and a minor setback. Optimal diversification varies by portfolio size and type, but it’s the buffer you need against market volatility.

The Perils of Short-Termism: A Myopic View

Obsessing over short-term fluctuations can cloud your judgment. It’s like trying to read a book by only looking at one letter at a time—you miss the bigger picture. Keep your eyes on the horizon, not just the step in front of you.

The High Cost of Emotional Trading: Buy High, Sell Low

Market swings can provoke emotional responses—fear and greed leading the charge. These emotions often culminate in the classic folly: buying high in a frenzy and selling low in a panic. Remember, emotional trading is expensive trading.

The Price of Overactivity: Trading Too Much

Frequent trading can seem like agility, but it’s often a mirage. Each transaction comes with a cost and a hyperactive approach can lag market returns significantly. Remember, patience is a virtue.

The Silent Eroders: Fees and Taxes

Fees and taxes can nibble away at your returns like termites on wood. They might seem insignificant at first, but over time, they can compromise the integrity of your portfolio’s growth. It’s essential to keep these costs in check, ensuring they don’t eat away at your hard-earned gains.

Regular Reviews: The Pulse Check

Think of your portfolio as a living entity—it needs regular check-ups. As your life evolves, so should your investments. This isn’t about reacting to every market sneeze but ensuring that your portfolio reflects your current circumstances and goals.

Risk: Knowing Your Comfort Zone

Risk is not one-size-fits-all. Too much can send you into a tailspin, while too little might ground your potential for growth. Understand your personal threshold and adjust your investments accordingly.

Performance Blind Spots: Ignorance Isn’t Bliss

Not knowing your investment performance is like driving with a blindfold. Regularly review your returns, considering fees and inflation, to ensure you’re on the path to meeting your financial objectives.

The Long Game: Investing Consistently

The marvel of compound interest shows its true colours over time. Delaying your investment start date can significantly impact your end goal. Consistent investing, even in small amounts, can yield a substantial portfolio over the long haul.

Control: Focusing on What’s in Your Hands

While the market’s whims are beyond your control, your actions are not. Diligent investing, staying informed, and focusing on the controllable elements can align the stars in your favour, propelling you toward your financial aspirations.

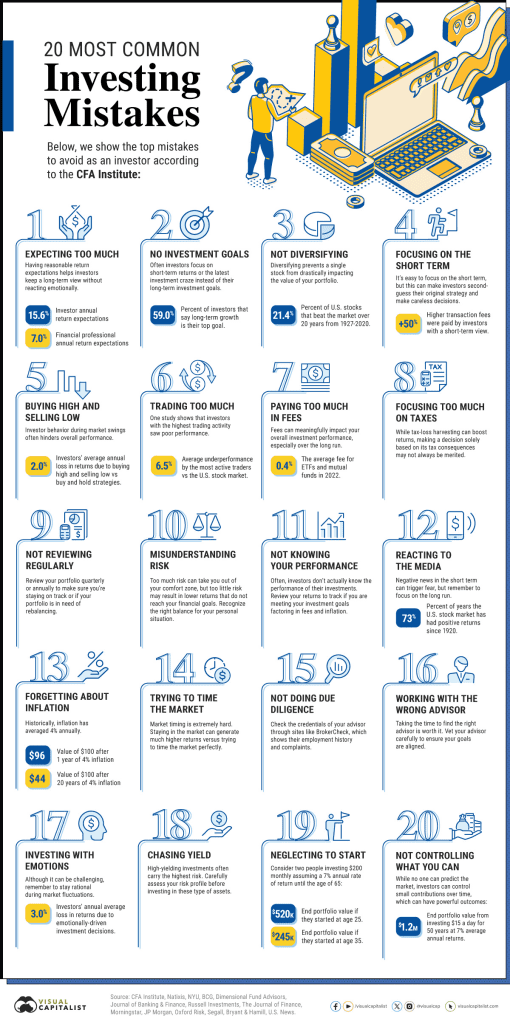

The chart below from Visual Capitalist provides a summary of some of the most common investing mistakes.

To navigate this complex investment landscape, remember to remain rational and goal-oriented. By circumventing these common mistakes and focusing on the long-term horizon, you position yourself not just to participate in the market, but to thrive within it. As you build your portfolio, consider these lessons as guideposts, ensuring that every step you take is measured, deliberate, and aligned with your path to prosperity.